|

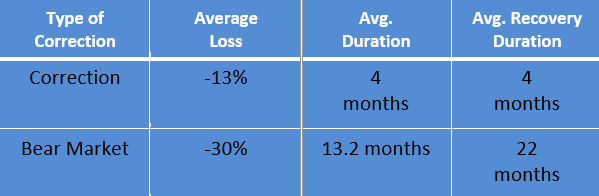

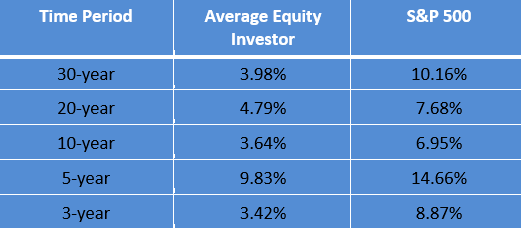

The 2020 election cycle is in full swing. It’s primary season, which means the general election is right around the corner. Before you know it, the two major parties will have their conventions and we’ll be heading to the ballot box. Of course, you may already have election fatigue. From the local level all the way up to national races, candidates are already flooding television with political ads. As is the case in most presidential elections, candidates are also talking about the economy. They may make claims about what will happen in the economy if they’re elected or that the markets might decline if their opponent is elected. That kind of rhetoric is common during elections, but is it accurate? Will the outcome of the election impact your portfolio? Should you worry about the election? Or perhaps even change your allocation to protect yourself. Below are a few tips to keep in mind through the rest of the election year: Keep history in perspective. Often when there is one issue or story dominating the news, like the presidential election, it’s easy to focus solely on that story. It’s in the news and on social media so much that it feels like it’s the most important issue in the world. However, the truth is that this country and the stock market have been through many presidential elections. In fact, in most of those years, the markets performed positively. In fact, since 1928, there have been 23 presidential elections. In 19 of those years, the S&P 500 had a positive return.1 In fact, in the four instances when the markets did have negative returns, there were also economic events happening that may have driven the performance. In 1932, the country was in the midst of the Great Depression. In 1940, the country was entering World War II. The markets declined in 2000, which was the year George W. Bush ran against Al Gore. However, the bursting tech bubble in Silicon Valley may have had more influence on the markets than the election. Finally, in 2008, the S&P 500 also declined, but that was the year of the financial crisis. The takeaway is that market declines can happen in any year. The fact that it’s an election year may cause news stories and rhetoric, but the market is likely driven by investor concerns and economic conditions. Focus on the long-term. Your investment strategy was likely designed for the long-term. Perhaps you’re saving for retirement or some other goal that is years or possibly even decades in the future. Over that period, you’ll likely see times of market volatility. Whether it’s an election year or not, it’s always helpful to focus on the long-term during challenging periods. Market downturns happen, but they are always temporary. There are two common types of downturns: corrections and bear markets. Corrections are losses of 10% or more. Bear markets are losses of 20% or more. As you can see in the chart below, the average correction loses around 13% and the average bear market sees a loss of around 30%.2 However, the duration of each is also important. A correction, on average, lasts around four months. After that period, there is an average four-month recovery period to recoup the losses. Bear markets last longer. They have an average duration of 13 months with a 22-month recovery period.2 Market downturns are never pleasant, but they are temporary. Keep an eye on the long-term and stick to your strategy. Don’t make gut decisions. It can be easy to make a gut, impulse decision when you hear and see stressful news on a regular basis. It might be tempting to sell your investments and move to asset classes that have less risk and volatility. However, a move to perceived safety could do more harm than good. The chart below shows how the average equity investor has fared compared the S&P 500 over different periods of time. As you can see, the index always wins, sometimes by a wide margin. 3 Why does this happen? Primarily because the index stays invested at all times, while the average investor is constantly moving in and out of the market based on gut decisions or attempts to avoid loss. While investors may miss some declines with this strategy, they also miss out on gains. Staying invested usually leads to better long-term performance.

Ready to protect your portfolio this election year? Let’s talk about it. Join us on Tuesday, March 31st or Wednesday, April 1st at 7 p.m. to learn more and have your questions answered. You can register here. Can’t make our upcoming workshop? Contact us at Kincaid Financial Resources. We can help you analyze your needs and develop a strategy. Let’s connect soon and start the conversation. You can reach us here. 1https://www.thebalance.com/presidential-elections-and-stock-market-returns-2388526 2https://www.cnbc.com/2018/12/24/whats-a-bear-market-and-how-long-do-they-usually-last-.html] 3https://www.marketwatch.com/story/americans-are-still-terrible-at-investing-annual-study-once-again-shows-2017-10-19 This information is designed to provide a general overview with regard to the subject matter covered and is not state specific. The authors, publisher and host are not providing legal, accounting or specific advice for your situation. By providing your information, you give consent to be contacted about investments and potential insurance products as deemed appropriate by a licensed fiduciary. This information has been provided by a Licensed Insurance Professional and does not necessarily represent the views of the presenting insurance professional. The statements and opinions expressed are those of the author and are subject to change at any time. All information is believed to be from reliable sources; however, presenting insurance professional makes no representation as to its completeness or accuracy. This material has been prepared for informational and educational purposes only. It is not intended to provide, and should not be relied upon for, accounting, legal, tax or investment advice. This information has been provided by a Registered Investment Advisor and Licensed Insurance Professional and is not sponsored or endorsed by the Social Security Administration or any government agency. Advisory services offered through ChangePath, LLC, a Registered Investment Adviser with the SEC. ChangePath, LLC and Kincaid Financial Resources are unaffiliated entities.

0 Comments

It’s been a volatile few weeks in the financial markets. Up until late January, we were still enjoying the longest bull market in history. In three short weeks, the bull market has ended, and we’ve entered bear market territory. Between Friday, February 21 and Monday, March 16, the Dow Jones Industrial Average has dropped by 30.37%.1

The rapid decline has left many investors with two questions:

There’s no easy answer to the first question. If history is any guide, eventually the decline will stop, and the markets will recover. The average bear market lasts 13 months, followed by a 22-month recovery.2 However, it’s impossible to predict when that recovery might begin. The second question is even more difficult to answer. There are certainly protection options available, but not all options are right for all investors. Your strategy should be based on your unique needs, goals, and tolerance for risk. Below are a few options you have available: Shifting to a more conservative allocation. Changing your allocation to a more conservative strategy is always an option. Many people become more risk averse as they approach retirement. If you haven’t reviewed your allocation in years, this may be the right time to do so. Of course, a more conservative allocation could limit your participation in a recovery when it happens. Work with a financial professional to find an allocation that limits your exposure to further losses, but still gives you an opportunity to participate future upside. Staying the course. Another option is to stay the course and stay invested in your current allocation. Again, that may expose you to further losses, but it could also put you in a position to take advantage of a recovery when it does happen. Again, it’s impossible to predict when a recovery could happen, but history can provide some insight. The last bear market started in October 2007 and lasted until March 2009, spanning much of the financial crisis. The S&P 500 dropped 56.8%. However, the subsequent bull market (which just ended) lasted more than 10 years and saw the S&P 500 increase by more than 400%.3 The 2000 bear market was triggered by the tech bubble. It lasted nearly 30 months and saw a total decline of more than 49%. It was followed by a 60-month bull market with a return of more than 100%. The 1990 bear market lasted only three months and had a decline of 20% and it was followed by a 113-month bull market with a cumulative return of 417%.3 Bear markets are often followed by bull markets. The question is whether you can stick it out through further losses. Again, your financial professional can talk through your options with you and help you decide which path is right. Use risk-protection vehicles. Another option is to take advantage of market risk-protection vehicles like annuities. There is a wide range of different types of annuities that can limit your exposure to market risk and protect your future. For example, some guarantee your principal against loss, but also offer upside growth potential. Others guarantee your future retirement income, no matter how the market performs in the future. A financial professional can help you determine if an annuity or other risk-protection tool is right for you. Ready to protect your nest egg from the coronavirus? Let’s talk about it. Contact us today at Kincaid Financial Resources. We can help you analyze your investments and implement a strategy. Let’s connect soon and start the conversation. You can reach us here. 1https://www.google.com/search?safe=off&sa=X&tbm=fin&sxsrf=ALeKk02Fk2yPH2_A7nU0wQGE5IUIixHyGQ:1584394531365&q=INDEXDJX:+.DJI&stick=H4sIAAAAAAAAAONgecRozC3w8sc9YSmtSWtOXmNU4eIKzsgvd80rySypFBLjYoOyeKS4uDj0c_UNkgsry3kWsfJ5-rm4Rrh4RVgp6Ll4eQIAqJT5uUkAAAA&ved=2ahUKEwiBmOfJ-Z_oAhWUW80KHc2dA3MQ3N8BMAJ6BAgCEAM#scso=_SfFvXsWJMJe1tAbX6pm4BQ1:0 27https://www.cnbc.com/2018/12/24/whats-a-bear-market-and-how-long-do-they-usually-last-.html 3https://www.cnbc.com/2020/03/14/a-look-at-bear-and-bull-markets-through-history.html This information is designed to provide a general overview with regard to the subject matter covered and is not state specific. The authors, publisher and host are not providing legal, accounting or specific advice for your situation. By providing your information, you give consent to be contacted about investments and potential insurance products as deemed appropriate by a licensed fiduciary. This information has been provided by a Licensed Insurance Professional and does not necessarily represent the views of the presenting insurance professional. The statements and opinions expressed are those of the author and are subject to change at any time. All information is believed to be from reliable sources; however, presenting insurance professional makes no representation as to its completeness or accuracy. This material has been prepared for informational and educational purposes only. It is not intended to provide, and should not be relied upon for, accounting, legal, tax or investment advice. This information has been provided by a Registered Investment Advisor and Licensed Insurance Professional and is not sponsored or endorsed by the Social Security Administration or any government agency. Advisory services offered through ChangePath, LLC, a Registered Investment Adviser with the SEC. ChangePath, LLC and Kincaid Financial Resources are unaffiliated entities. 19926 - 2020/3/17 Do you use a 401(k) or IRA to save for retirement? You’re not alone. These types of accounts are popular for many reasons, but one of the biggest is their tax treatment. As you may know, these accounts are tax-deferred. That means you don’t pay taxes on growth as long as the funds stay inside the account.

Qualified accounts may also offer upfront tax benefits for your contributions. Contributions to your 401(k) come out on a pre-tax basis. That reduces your taxable income, which in turn reduces your taxes. Contributions to an IRA.may also be tax-deductible, depending on your income level. Qualified accounts aren’t completely tax-free, however. While you may get a deduction upfront and taxes may be deferred over time, eventually, you do have to pay taxes on these assets. That time is usually when you take withdrawals in retirement. Most distributions from qualified accounts are taxed as income. That could be problematic if you plan on using your 401(k) or IRA to generate most of your retirement income. You could create high levels of taxable income that may create a significant tax liability, which could reduce your net income and your ability to live a comfortable lifestyle. Fortunately, you can minimize your tax burden by planning ahead. Every situation is unique, so there’s no universal strategy that is right for everyone. However, the following three-step process can help you project your tax liability in retirement and take steps to control it. List all your sources of retirement income. The first step in managing your retirement taxes is to project just exactly where your income will come from. In fact, this isn’t just useful for tax planning; it’s important for your entire retirement strategy. Make a list of all your potential income sources. The list could include things like:

Categorize them by tax treatment. Once you have your list, you can start to categorize your income sources according to how they are taxed. Some income sources will likely be taxable, like:

Other types of income may be tax-free, such as:

And finally, there could be some sources of income that simply require more research. They may be taxable, but also may not be. It could depend on your total taxable income or perhaps other factors. These types of income could include:

Meet with a professional and develop a tax strategy. The final step is to work with a professional to create a detailed projection of your potential income and tax liability in retirement. They can estimate your income and your possible taxes each year. They can then work with you to develop a strategy that minimizes tax payments. For example, they might recommend the use of tax-free income from municipal bonds or a Roth IRA. They could suggest the use of life insurance to create tax-free income. They may recommend that you delay Social Security or choose a different pension benefit to reduce your taxable income. A financial professional can help you find the strategy that is best for your needs. Ready to develop your retirement tax strategy? Let’s talk about it. Contact us at Kincaid Financial Resources. We can help you analyze your needs and develop a strategy. Let’s connect soon and start the conversation. You can reach us here. This information is designed to provide a general overview with regard to the subject matter covered and is not state specific. The authors, publisher and host are not providing legal, accounting or specific advice for your situation. By providing your information, you give consent to be contacted about investments and potential insurance products as deemed appropriate by a licensed fiduciary. This information has been provided by a Licensed Insurance Professional and does not necessarily represent the views of the presenting insurance professional. The statements and opinions expressed are those of the author and are subject to change at any time. All information is believed to be from reliable sources; however, presenting insurance professional makes no representation as to its completeness or accuracy. This material has been prepared for informational and educational purposes only. It is not intended to provide, and should not be relied upon for, accounting, legal, tax or investment advice. This information has been provided by a Registered Investment Advisor and Licensed Insurance Professional and is not sponsored or endorsed by the Social Security Administration or any government agency. Advisory services offered through ChangePath, LLC, a Registered Investment Adviser with the SEC. ChangePath, LLC and Kincaid Financial Resources are unaffiliated entities. 19662 - 2020/1/16 |

Categories

All

Archives

February 2021

|

Advisory Services offered through CreativeOne Wealth, LLC a Registered Investment Adviser. CreativeOne Wealth, LLC and Kincaid Financial Resources are unaffiliated entities.

Licensed Insurance Professional. We are an independent financial services firm helping individuals create retirement strategies using a variety of investment and insurance products to custom suit their needs and objectives. Investing involves risk, including the loss of principal. No Investment strategy can guarantee a profit or protect against loss in a period of declining values. Any references to protection or lifetime income refer to fixed insurance products, never securities or investment products. Insurance and annuity products are backed by the financial strength and claims-paying ability of the issuing insurance company.

The information is not intended to be investment, legal or tax advice. The agent can provide information, but not advice related to social security benefits. The agent may be able to identify potential retirement income gaps and may introduce insurance products, such as an annuity, as a potential solution. For more information, contact the Social Security Administration office, or visit www.ssa.gov.

Licensed Insurance Professional. We are an independent financial services firm helping individuals create retirement strategies using a variety of investment and insurance products to custom suit their needs and objectives. Investing involves risk, including the loss of principal. No Investment strategy can guarantee a profit or protect against loss in a period of declining values. Any references to protection or lifetime income refer to fixed insurance products, never securities or investment products. Insurance and annuity products are backed by the financial strength and claims-paying ability of the issuing insurance company.

The information is not intended to be investment, legal or tax advice. The agent can provide information, but not advice related to social security benefits. The agent may be able to identify potential retirement income gaps and may introduce insurance products, such as an annuity, as a potential solution. For more information, contact the Social Security Administration office, or visit www.ssa.gov.

RSS Feed

RSS Feed